Through a surety bond, the surety agrees to uphold-for the benefit of the obligee-the contractual promises (obligations) made by the principal if the principal fails to uphold its promises to the obligee. They pay out cash to the limit of guaranty in the event of the default of the Principal to uphold his obligations to the Obligee, without reference by the Obligee to the Principal and against the Obligee's sole verified statement of claim to the bank. If issued by banks they are called "Bank Guaranties" in English and Cautions in French, if issued by a surety company they are called surety / bonds.

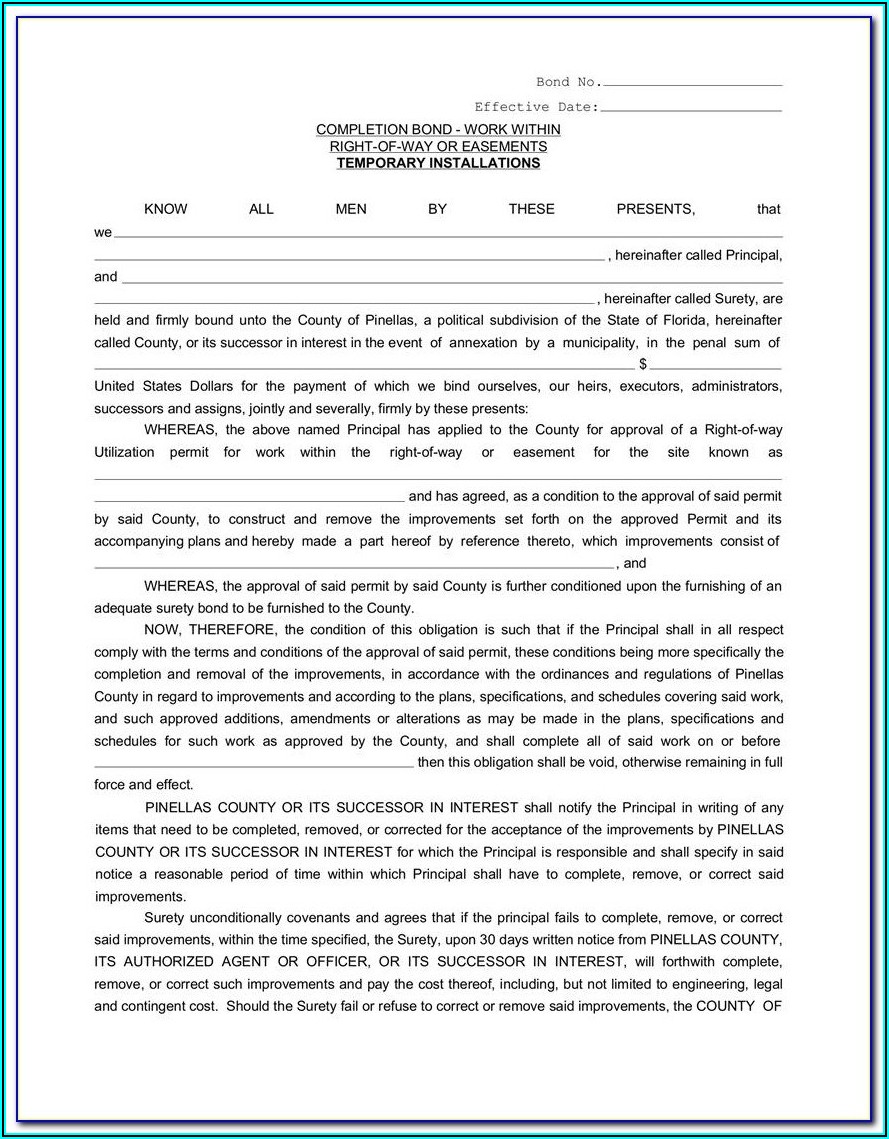

Bonding off a lien claim can be difficult and expensive.

It is important for claimants to understand that once a lien is bonded off, they will have to familiarize themselves with the process and what is required next (i.e., new deadline to file a claim against the bond).Just because a lien is bonded does not mean they are clear.Mechanics liens are frustrating for GCs and owners because they put the project on hold and potentially put the property at risk for foreclosure.An owner can also be sure the property title will be free.It allows the project to continue without interruption from mechanics liens.Is a more streamlined process than foreclosure.When a lien is bonded, the surety steps in with funds to pay the claim.It prevents parties from having to navigate the lien foreclosure process, which can be tedious and expensive.If a lien claim is threatened, best practice for a general contractor is to contact its bonding agent and attorney immediately to coordinate the bonding off of the lien claim. When the claim of non-payment arises, any proceeds from a claim will come from the bond itself. In a claims scenario, the claimant would have a surety bond claim against a surety bond or the mechanics lien bond.

#RCMD SURETY BOND FREE#

While this does not free them from their obligation to pay off their debt, it serves as a substitute of one form of payment security to another. Lien release bonds can be a useful way for owners to free their property from lien claims, enabling them to refinance or sell the property. When the owner or general contractor purchases this bond, the claim is released from the property and attaches to the bond instead. What is a Lien Release Bond?Ī lien release bond is a surety bond that takes the place of a mechanic lien on a property. While this tool is indeed powerful, what happens when the contractor or property owner bonds off your mechanics lien? We’ll take a deep dive into what this means and also take a look at the benefits and disadvantages for both the subcontractor and the prime/property owner. It allows them to claim a legal right to the property itself. In the construction industry, project participants may file a mechanics lien as a powerful collection tool.

0 kommentar(er)

0 kommentar(er)